3. Research

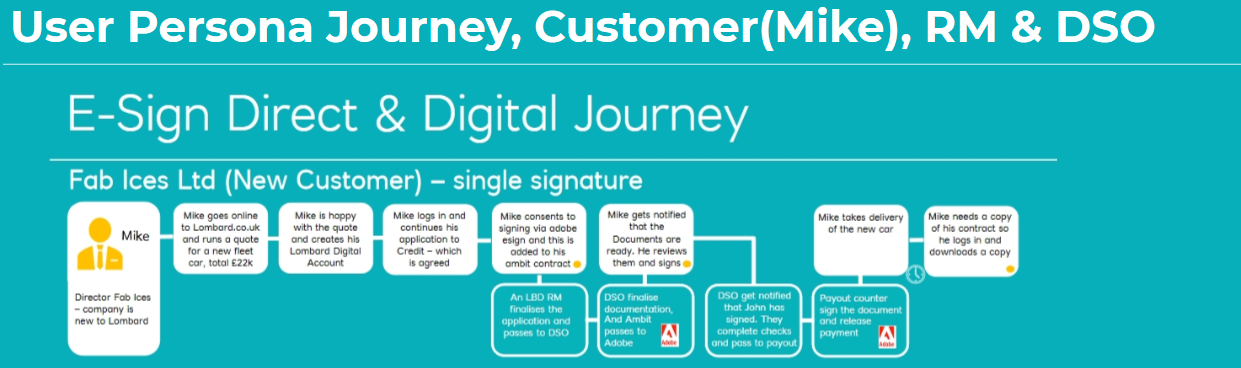

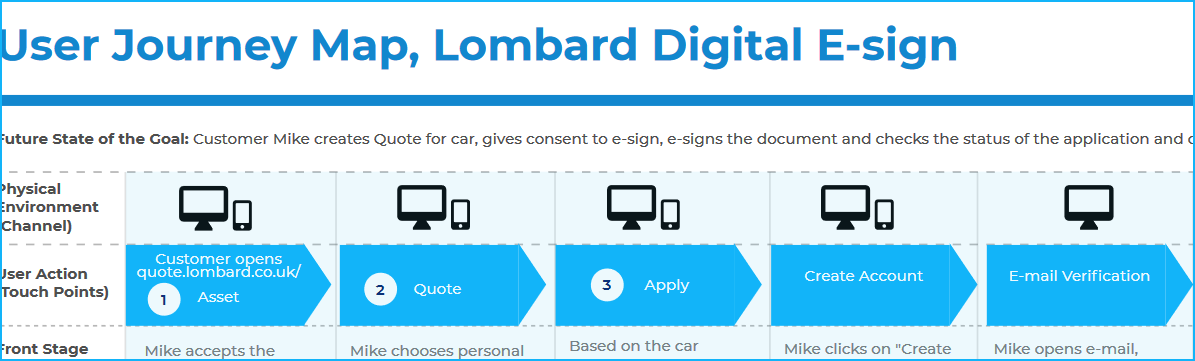

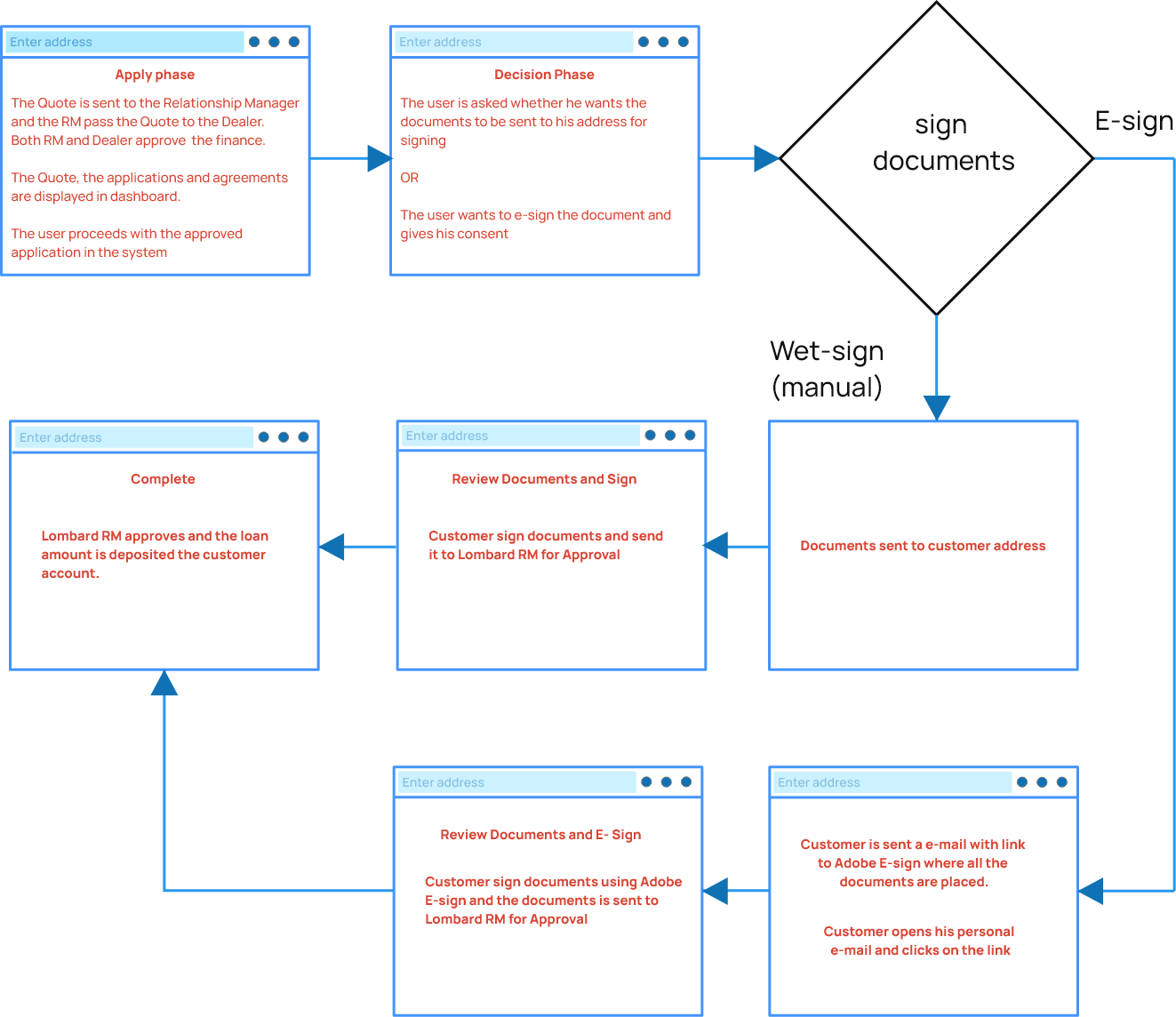

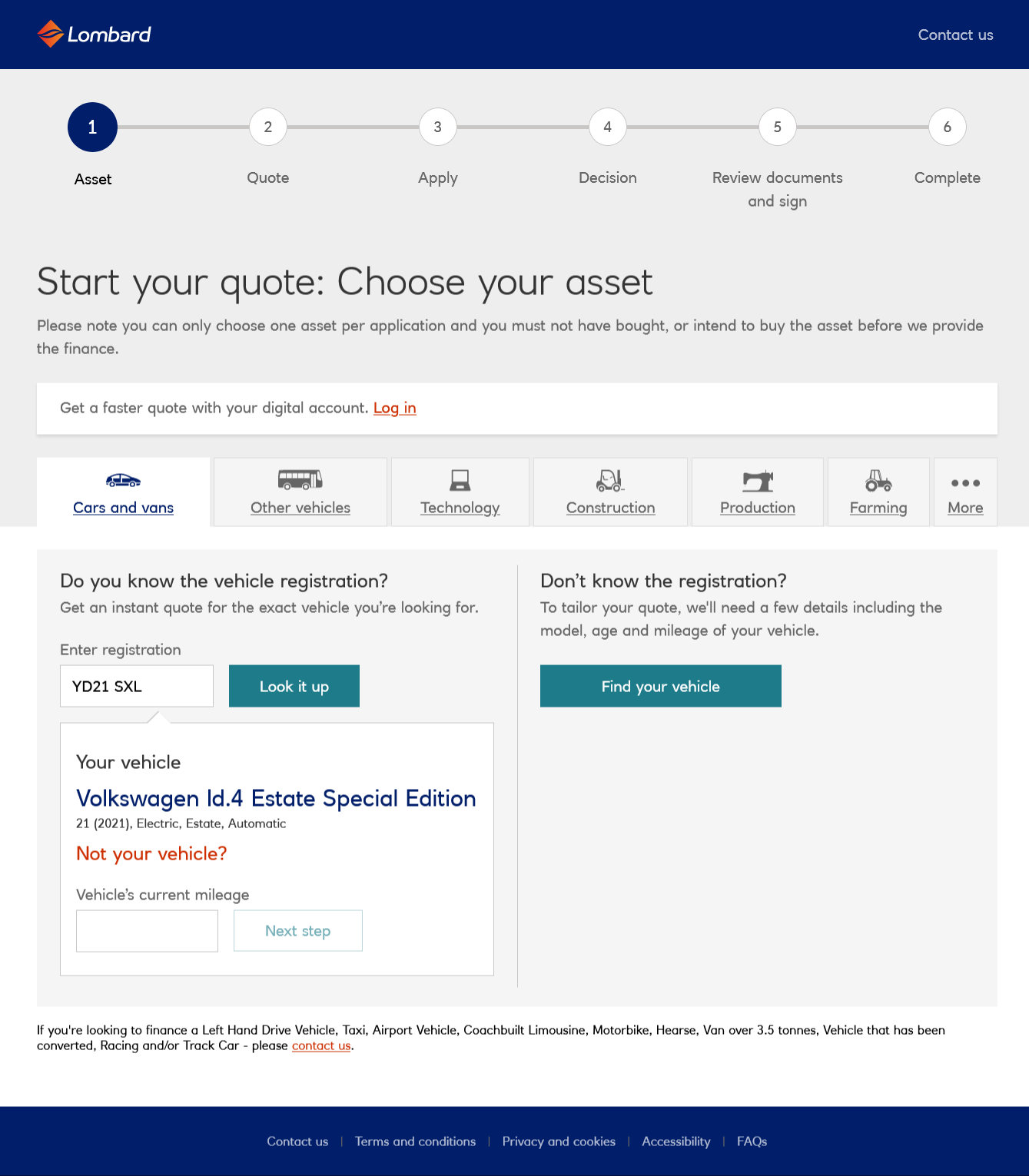

This project addresses three critical issues in Lombard's document signing process: obtaining proper user consent, streamlining multi-party e-signature workflows, and promoting Adobe E-sign adoption while ensuring GDPR compliance.

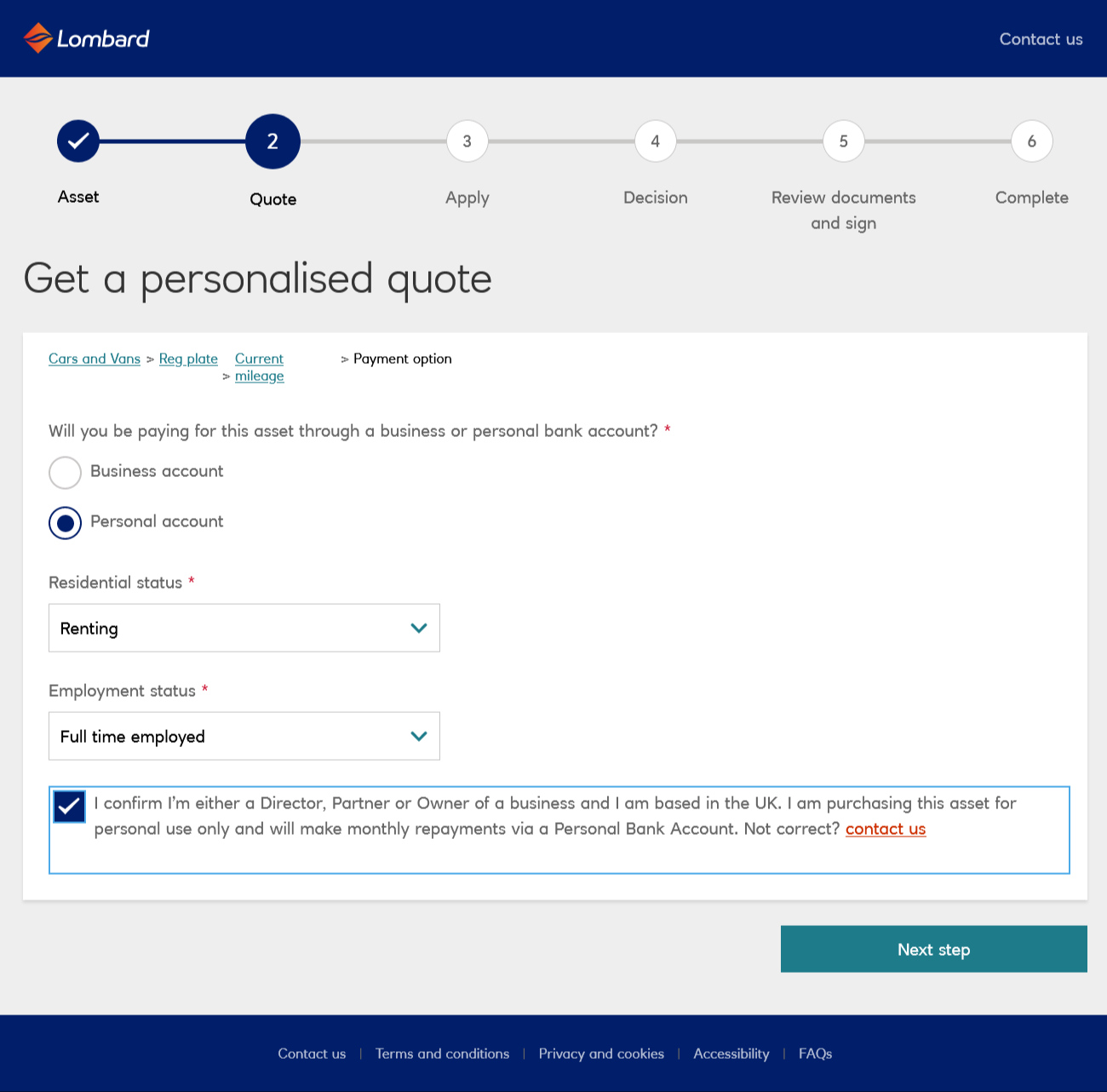

GDPR Compliance Challenge:UK companies must adhere to General Data Protection Regulation (GDPR) to protect European users during online transactions. Currently, Lombard's platform lacks proper consent mechanisms before collecting and using customer data.

Key Challenges:

1. Missing User Consent: Relationship Managers cannot legally contact customers via email, phone, or SMS without explicit consent for document signing processes.

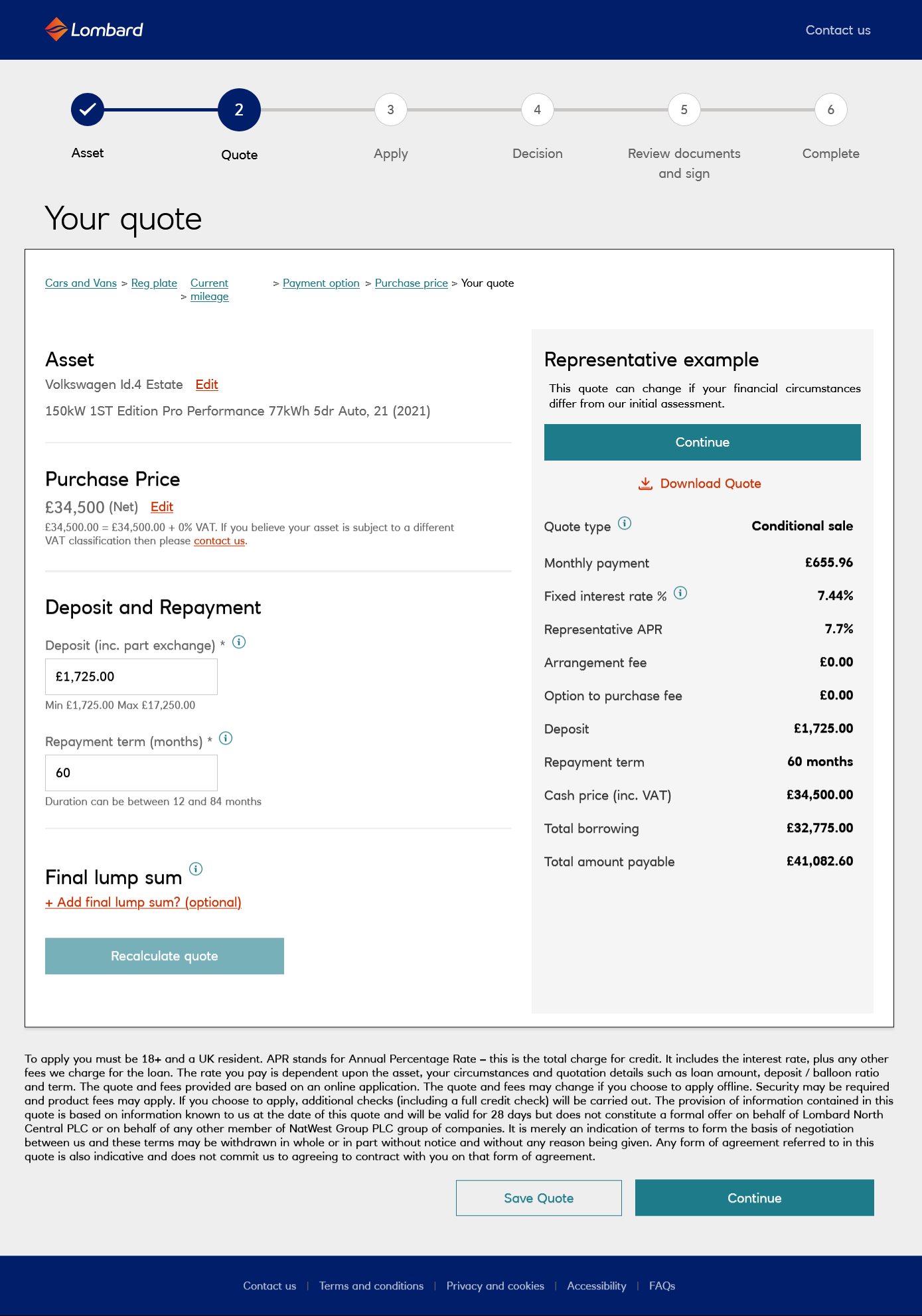

2. E-signature Adoption: Users need guidance and encouragement to utilize Adobe E-sign for both single and multi-party document signing.

3. Security Assurance: Users must feel confident that their data and documents are protected throughout the e-signing process.

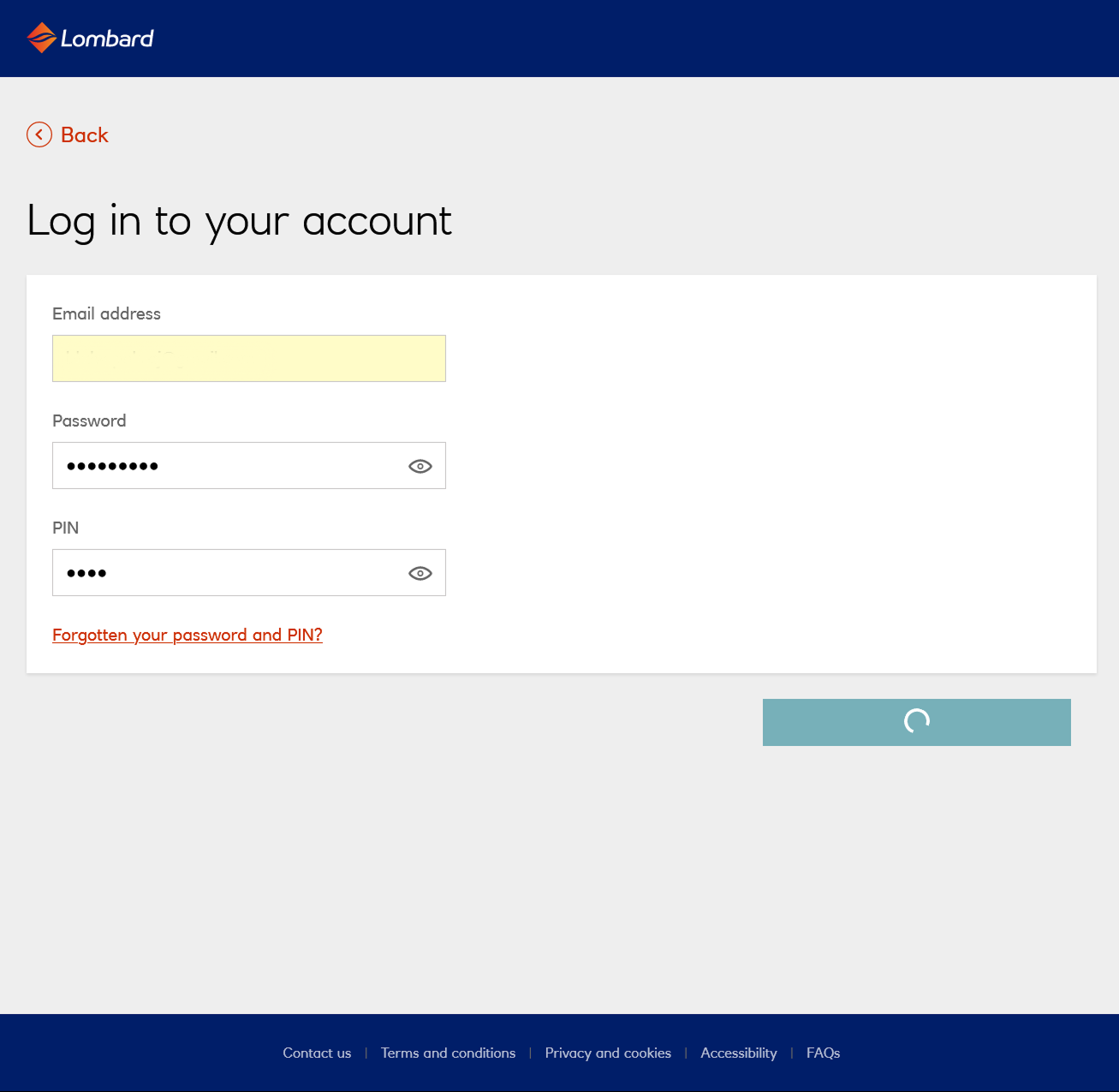

Current State: The existing platform allows registration with email and phone number but fails to capture necessary consent before sending quotes, finance approvals, or other communications to users.